Surprise, there were neither higher highs, nor lower lows, and instead, the SPX just tagged last week highs. So, we should give the current trend the benefit of the doubt. Therefore, keep on watching for a movement above or below the support/resistance lines and channels, as suggested before.

Considering this is opex week, I would interpret the next two CIT dates as marking the usual option player shakeout, and then a fizzle for the rest of the week.

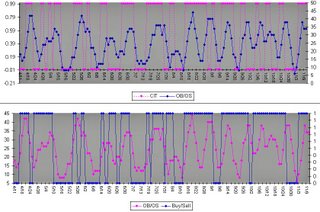

I’ve made frequent references to my Overbought/Oversold (“OB/OS”) Indicator. It is a mixed leading/coincidental indicator. At times it enables me to predict several days in advance when the market will lose or gather steam either on the upside or the downside. It’s been very gratifying to see how well this indicator works together with the CIT dates. The chart above makes the point.

I’ve also included the results from a mechanical long/short trend-following system which I like to keep an eye on.

Considering this is opex week, I would interpret the next two CIT dates as marking the usual option player shakeout, and then a fizzle for the rest of the week.

I’ve made frequent references to my Overbought/Oversold (“OB/OS”) Indicator. It is a mixed leading/coincidental indicator. At times it enables me to predict several days in advance when the market will lose or gather steam either on the upside or the downside. It’s been very gratifying to see how well this indicator works together with the CIT dates. The chart above makes the point.

I’ve also included the results from a mechanical long/short trend-following system which I like to keep an eye on.