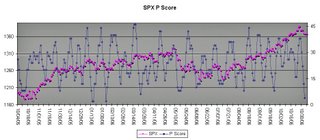

These are the CIT dates for December.

The key levels to watch today are 1393 and 1793 basis the futures.

There will be a more extensive update over the week-end.

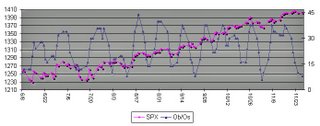

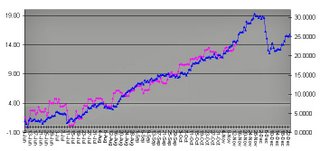

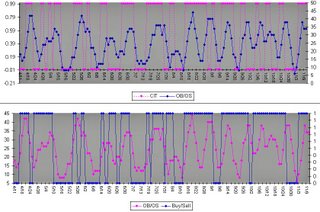

Cycle and technical analysis used to identify future Change in Trend (CIT) dates for the SPX and the major indices.

All rights reserved by the author. The material contained herein is original content and is the sole property of the author. Any commercial use or reproduction - either in part or whole - is strictly forbidden without the author's prior consent.

Disclaimer: The information provided here is for educational purposes only and does not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances.