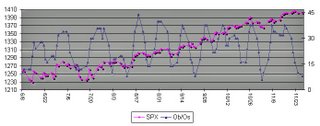

Two weeks ago I spoke about the interaction between the CIT dates and the Overbought/Oversold (OB/OS) indicator. Last week was a textbook example of how they complement each other.

The OB/OS indicator reached its peak on 11/16. However, the SPX registered its highest reading on 11/22 just as anticipated by the CIT date. Since OB/OS has been deteriorating for several days now, it has already reached oversold levels.

I took the liberty of extending the chart above by 1 day to point out where the indicator will be on Monday if the Friday sell-off continues. Considering that 11/27 is a CIT date, I would presume that the lows on Monday will provide a good swing trade entry point.