Market Breadth Data******************************

Monday, November 21, 2011

Tuesday, November 15, 2011

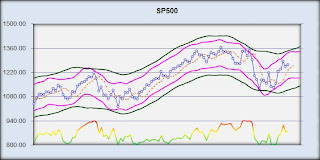

As explained in the User Guide, one should expect the RR oscillator to remain overbought in a downtrend market (cautioning not to get long prematurely), oversold in an uptrend market (cautioning not to get short too early), and to match a traditional oscillator in a sideways market. By contrast, in a trending market, a traditional oscillator will give numerous false overbought/oversold signals.

Friday, November 11, 2011

Subscribe to:

Comments (Atom)

Terms of Use

All rights reserved by the author. The material contained herein is original content and is the sole property of the author. Any commercial use or reproduction - either in part or whole - is strictly forbidden without the author's prior consent.

Disclaimer: The information provided here is for educational purposes only and does not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances.