FB has regained the uptrend channel with first target at 65.5:

Market Breadth Data******************************

Friday, January 31, 2014

$SPX Channel

The battle for the top of the '09 channel continues for the 6th day in a row:

Market breadth has been improving steadily in the morning.

Market breadth has been improving steadily in the morning.

Thursday, January 30, 2014

$SPX $IWM Targets and Market Internals

Bulls managed to pull the index back above the '09 channel line, but the real test of strength, or lack thereof, will come at 1815. Any rebound below that level should be considered a dead cat bounce:

The Russell 2000 survived the onslaught and is facing resistance at 113.5:

The Russell 2000 survived the onslaught and is facing resistance at 113.5:

$WRLD @HedgeFundDarling

Hedge Funds Ask the Consumer Bureau to do their Bidding:

One has to wonder how many are still short ?

Do they have the same pain threshold as Bill Ackman !?

One has to wonder how many are still short ?

Do they have the same pain threshold as Bill Ackman !?

Wednesday, January 29, 2014

$SPX Battleground

All the action continues to focus around the top of the '09 channel which is being tested and retested on a daily basis:

Tuesday, January 28, 2014

$AAPL and Market Trends

AAPL closed right on support:

and dragged the Qs further down:

while the SPX is testing the top of the '09 channel from underneath:

and dragged the Qs further down:

while the SPX is testing the top of the '09 channel from underneath:

Monday, January 27, 2014

Saturday, January 25, 2014

$QQQ and Market Internals

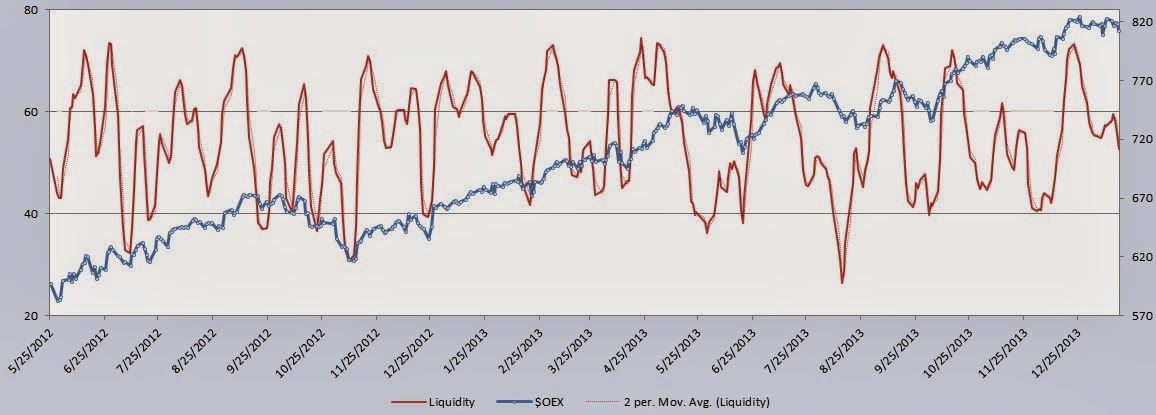

QQQ with NASDAQ A/D Line:

The parabolic ascent may be coming to an end, but the A/D line is still on trend.

The parabolic ascent may be coming to an end, but the A/D line is still on trend.

Friday, January 24, 2014

$SPX Channels

As a result of today's sell off, the SPX is back within the '09 channel:

The futures continued their slide after hours to 1780.

Channel support at 1750, regression line at 1700, median line at 1650.

The futures continued their slide after hours to 1780.

Channel support at 1750, regression line at 1700, median line at 1650.

Thursday, January 23, 2014

Wednesday, January 22, 2014

$QQQ, $SPX and $DJIA Technicals

The Qs keep advancing one doji at a time:

and are in familiar vertical ascend mode:

while the SPX and the DJIA remain stuck below resistance:

and are in familiar vertical ascend mode:

while the SPX and the DJIA remain stuck below resistance:

Tuesday, January 21, 2014

Sunday, January 19, 2014

Friday, January 17, 2014

$BBBY Trend and Targets

$BBBY has a history of bouncing off fib retracement levels:

Despite the strong sell-off, the stock is still in a weekly and monthly uptrend.

Despite the strong sell-off, the stock is still in a weekly and monthly uptrend.

Thursday, January 16, 2014

Wednesday, January 15, 2014

$SPX and Market Trend

SPX closed a hair under the December '13 high:

and momentum is cautiously turning up:

following Russell and the Qs which are making new highs:

and momentum is cautiously turning up:

following Russell and the Qs which are making new highs:

Tuesday, January 14, 2014

Subscribe to:

Posts (Atom)

Terms of Use

All rights reserved by the author. The material contained herein is original content and is the sole property of the author. Any commercial use or reproduction - either in part or whole - is strictly forbidden without the author's prior consent.

Disclaimer: The information provided here is for educational purposes only and does not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances.