The SPX breakout continues with higher targets in play:

Market Breadth Data******************************

Friday, February 28, 2014

Thursday, February 27, 2014

$SPX Trend, Liquidity and "Global Mood"

SPX finally able to close above 1850:

Russell 2000 closing at a new high as well:

"Global mood" strongly diverging from bullish liquidity readings

Russell 2000 closing at a new high as well:

"Global mood" strongly diverging from bullish liquidity readings

Wednesday, February 26, 2014

Tuesday, February 25, 2014

$SPX Support Resistance Levels

There's new tentative support around the 1835 level:

Bulls and Bears are in a standstill once again:

Bulls and Bears are in a standstill once again:

Monday, February 24, 2014

Saturday, February 22, 2014

Friday, February 21, 2014

Thursday, February 20, 2014

Wednesday, February 19, 2014

Tuesday, February 18, 2014

$SPX Swing and Resistance Levels

SPX extending the current upswing to 8 days and approaching the key 1850 resistance level:

Select stocks with longer upswings in place: MHFI, PSA, EQR, HSY, AAPL, MAC, ORLY:

Select stocks with longer upswings in place: MHFI, PSA, EQR, HSY, AAPL, MAC, ORLY:

Sunday, February 16, 2014

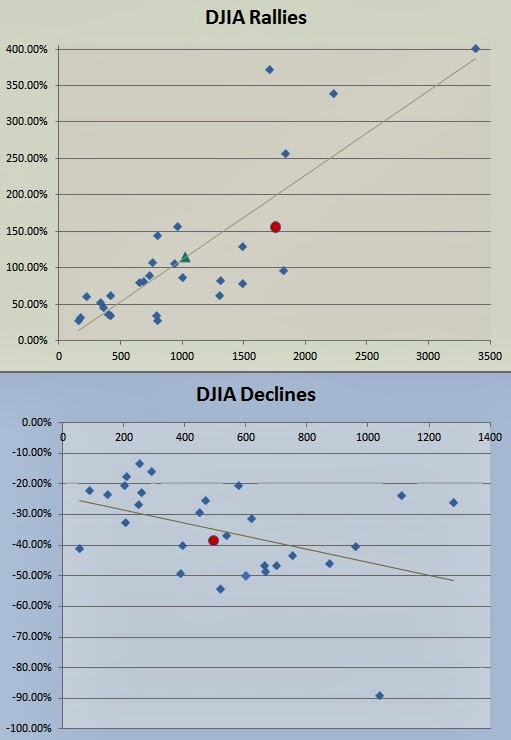

$DJIA Historical Rallies and Sell-offs

Following a rally lasting more than a 1500 days, and gaining more than 100%, the DJIA has been in a bear market lasting on average 500 days, accompanied by a 40% decline on average (red dot):

Friday, February 14, 2014

$ QQQ $DJIA Pattern and Targets

DJIA retesting the top of the megaphone:

while the Qs are testing the top of the '12 uptrend channel:

while the Qs are testing the top of the '12 uptrend channel:

$GLD $SLV Trend and Targets

GLD and SLV having a very strong day testing key resistance levels. A break above the 50% retracement will give gold a much more bullish outlook:

Thursday, February 13, 2014

$SPX and $QQQ Targets

SPX back within the congestion zone with strong resistance at the Dec. '13 and Jan. '14 highs:

The Qs made a new high but there's resistance close at hand as well:

The Qs made a new high but there's resistance close at hand as well:

Futures Slide

While the financial media will scramble for a reason why futures are sliding, and why good or bad news is sometimes good for the market and sometimes not, market sentiment provides a much more simple explanation: when everybody is bullish and already in -- who's left to buy; the tree needs to be shaken first:

Wednesday, February 12, 2014

$QQQ and $IWM A Tale of Two Stocks

The Qs pausing at the Jan '14 high:

while the broader Russell is trying to break back within the uptrend channel:

while the broader Russell is trying to break back within the uptrend channel:

Tuesday, February 11, 2014

SPX Target

SPX may be getting overstretched to the upside, but that didn't stop it from breaking above resistance and being on its way to target the December '13 and January '14 highs:

Monday, February 10, 2014

Saturday, February 08, 2014

$SPX and $DJIA Monthly Trend and Targets

The SPX is mimicking the rate of ascend of the '98 - '00 rally:

while the DJIA has advanced the same number of points as the '87 - '00 rally:

Previous tops took a few months to unfold.

while the DJIA has advanced the same number of points as the '87 - '00 rally:

Previous tops took a few months to unfold.

Friday, February 07, 2014

$QQQ and $IWM Trend and Targets

There are noticeable and opposite divergences between price and A/D line for the NDX and the Russell 2000:

Thursday, February 06, 2014

$SPX Ahead of the Jobs #

So far the SPX seems to be repeating earlier patterns (as long as price doesn't break below the lower channel line, or 1737):

$SPX New Signal

SPX starting the day with a buy signal and very strong market internals;

1770 is the key level to watch:

The weekly remains on a sell though:

1770 is the key level to watch:

The weekly remains on a sell though:

Subscribe to:

Posts (Atom)

Terms of Use

All rights reserved by the author. The material contained herein is original content and is the sole property of the author. Any commercial use or reproduction - either in part or whole - is strictly forbidden without the author's prior consent.

Disclaimer: The information provided here is for educational purposes only and does not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances.