Market Breadth Data******************************

Thursday, July 31, 2014

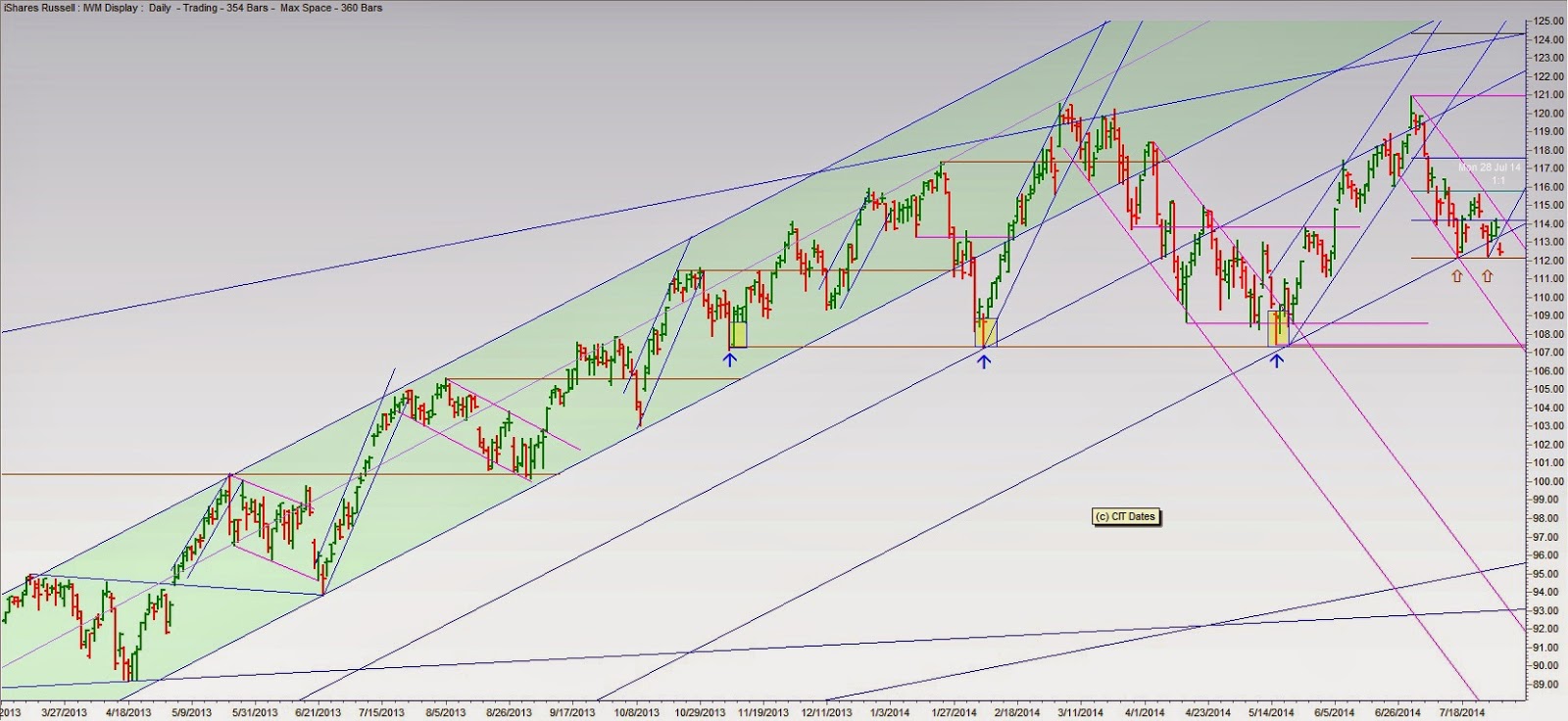

$IWM Channel and Trend

The negative divergence spotted at the double top made its presence known in a most emphatic way, leading to a retest of the bottom channel with lower targets not far away:

Wednesday, July 30, 2014

$IWM Channel and Trend

Decision time approaching for IWM. Still holding above double bottom support but right underneath channel and price resistance:

Tuesday, July 29, 2014

Monday, July 28, 2014

Friday, July 25, 2014

Thursday, July 24, 2014

Wednesday, July 23, 2014

$AAPL Channel and Trend

AAPL accelerating to the upside, closing in on double top:

SPY advance proceeding on schedule to fulfill average time and price projections

(time and price target data supplied by OT Signals)

SPY advance proceeding on schedule to fulfill average time and price projections

(time and price target data supplied by OT Signals)

Tuesday, July 22, 2014

$QQQ Channel and Trend

Qs leading the major averages on the way up, testing the upper channel line:

Ackman's presentation blowing up in his face:

Ackman's presentation blowing up in his face:

$SPY Trend and Targets

SPY with average bull/bear swing price and time targets:

(Bull/Bear swing target data courtesy of OT Signals)

(Bull/Bear swing target data courtesy of OT Signals)

Monday, July 21, 2014

Friday, July 18, 2014

Thursday, July 17, 2014

Saturday, July 12, 2014

Friday, July 11, 2014

Thursday, July 10, 2014

$SPX Channel and Trend

While the SPX was able once again to climb above the 1955 support/resistance level:

Russell 2000 continues to underperform:

Russell 2000 continues to underperform:

Wednesday, July 09, 2014

Tuesday, July 08, 2014

$SPX Trend and Support

SPX testing the June breakout level:

on the heels of overwhelmingly negative June 7th swing scan results:

on the heels of overwhelmingly negative June 7th swing scan results:

Monday, July 07, 2014

$IWM Channel and Trend

Russell 2000 testing the bottom of the channel:

after daily market breadth reaches overbought levels just before the July 4th holiday:

after daily market breadth reaches overbought levels just before the July 4th holiday:

Saturday, July 05, 2014

Thursday, July 03, 2014

$IWM and $QQQ Channel and Trend

Russell 2000 retesting first resistance level:

while the Qs are reaching for the top of the channel:

while the Qs are reaching for the top of the channel:

Wednesday, July 02, 2014

Tuesday, July 01, 2014

Subscribe to:

Posts (Atom)

Terms of Use

All rights reserved by the author. The material contained herein is original content and is the sole property of the author. Any commercial use or reproduction - either in part or whole - is strictly forbidden without the author's prior consent.

Disclaimer: The information provided here is for educational purposes only and does not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances.