There are no changes this week, neither in the daily nor weekly signals.

My major concern is that, judging by the Overbought/Oversold indicator, there doesn’t seem to be much upward potential between now and the next CIT date on Nov. 22nd.

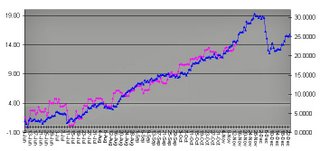

I’ve also updated the correlation chart, and everything is still in gear.

Action in today’s markets is not out of line with the past. For the period January-November the DJIA is exhibiting better than .9 correlation with 7 of the last 126 years. For the period June-November the number more than doubles to 15. Both composite correlation charts point to a sell-off in December. Does this mean that in 2006 the markets must go up until the first week of December, and then have a sizeable correction? Not necessarily, although it’s worth keeping in mind as a potential outcome.